Contents:

We advise you to carefully consider whether https://forexhistory.info/ is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The lower margin requirement might seem more attractive because it lets you take the same position with fewer dollars.

Your trading capacity is dramatically increased for comparatively little initial cost – magnifying and intensifying performance. Understanding what a margin closeout is and how it works is the first step to avoiding it. Maybe you didn’t use sufficient risk management tools, or didn’t have a comprehensive trading strategy, or didn’t stick to the plan due to emotional factors? Learning from mistakes is vital and will help you to recover. If you get a margin closeout, remember that it’s not the end of the world.

What are the consequences of a Margin Call?

If this happens, once your Margin Level falls further to ANOTHER specific level, then the broker will be forced to close your position. The account will be unable to open any new positions until the Margin Level increases to a level above 100%. If your account’s Margin Level reaches 100%, you will NOT be able to open any new positions, you can only close existing positions. For example, some forex brokers have a Margin Call Level of 100%. When this threshold is reached, you are in danger of the POSSIBILITY of having some or all of your positions forcibly closed (or “liquidated“). In forex trading, the Margin Call Level is when the Margin Level has reached a specific level or threshold.

64% of retail investor accounts lose money when trading CFDs with this provider. To avoid margin calls and stop-outs, it can be helpful to set a stop-loss on your trading account. A stop-loss will automatically close your trade when it reaches a predetermined point of your choice. You can place this at a percentage above or below the current market price.

Account opening

For riskier assets such as cryptocurrencies, which are not available to UK retail clients, it may be as high as 50%. Simply answer a few questions about your trading preferences and one of Forest Park FX’s expert brokerage advisers will get in touch to discuss your options. We give calls from Monday to Friday in suggested intervals. In case we couldn’t get through, we will try again at the same time the next day. Get tight spreads, no hidden fees, access to 12,000 instruments and more.

Forex Margin Requirements by Broker: What to Know • Benzinga – Benzinga

Forex Margin Requirements by Broker: What to Know • Benzinga.

Posted: Mon, 12 Oct 2020 06:45:57 GMT [source]

Receiving a Margin Call in the first place means most of them are in negative. FINRA regulations limit margin at purchase to at most 50%, and maintenance margin requirements to at least 25%. The investor must respond to the margin call by selling shares or depositing funds to avoid forced sale of their investments. The requirements for leverage may vary with account size or market conditions, and may be changed from time to time at the sole discretion of JMI. Traders should monitor margin balance on a regular basis and utilize stop-loss orders to limit downside risk. However, due to the extreme volatility that can be found in the Forex market, stop-loss orders are not always an effective measure in limited downside risk.

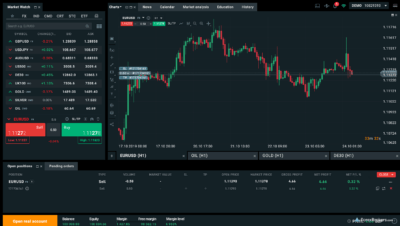

Trading Station Mobile

Margin calls can occur at any time due to a drop in account value. However, they are more likely to happen during periods of market volatility. Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. Let’s say you have a $1,000 account and you open a USD/CHF position with 1 mini lot that has a $200 Required Margin.

You do not want to be in a position where your broker has to sell your holdings quickly at a highly disadvantaged price with no chance for the price to recover. No one wants to see their positions closed automatically, and therefore you should ensure your account is sufficiently funded. It goes both ways, margin supercharges both gains and losses.

Margin call is the term for when you no longer have sufficient funds in your account to keep a leveraged position open. If you are placed on margin call then your positions are at risk of being closed automatically. A margin call must be satisfied immediately and without any delay.

The situation is different with the transfer of the positions to the next day or in the case of a serious force majeure. In any credit transaction, the lender also faces the loan default risk. A stop out is a signal that all active positions in the forex market will be closed automatically by the broker as your margin levels are too low to sustain the open positions.

- The exchange also traded USDRUB_TOD which settles on the same day (TOD – today).

- To avoid margin calls and stop-outs, it can be helpful to set a stop-loss on your trading account.

- Margin calls can occur at any time due to a drop in account value.

The higher is the volatility, the less should be the leverage, used in margin trading. Trader’s risks are in most cases limited by the deposit size. Any theory is needed not only to be employed in practice, but also to be a basis for forecasts.

How can you avoid a margin call?

In this case, the money taken by a broker ($500) is called used margin and it is one of the main elements of determining how much funds a trader has to open new trades. Using available equity and used margin, a trader can calculate a margin level and try to avoid margin call in Forex. However, if the price still continues to decline and your margin level goes even lower the Forex margin call level, a trader gets to the new level – the “stop out” level.

And right after it crosses the 100% line and a trader fails to refill the account, the broker gets the ability to liquidate trader’s positions manually. The elements we discussed above are necessary to keep track of the account balance and make sure that nothing unexpected happens. However, no trader can be certain that the currency prices don’t fall and their account balance doesn’t reduce. You could be subject to a margin call and forced to either deposit more money to your account or to sell some of your holdings to free up capital as collateral for your open position. The formula for calculating the margin for a forex trade is simple. Just multiply the size of the trade by the margin percentage.

Find out which account type suits your trading style and create account in under 5 minutes. Free margin represents the amount of capital you have remaining to place new trades or cover any negative price moves in your open trades. There are two things that a trader needs to know about how Forex works before they start trading. For example, Capital.com offers a 10% margin on silver CFDs.

Clients may request to waive/https://forexanalytics.info/ the maximum exposure limit. Demo Registration is currently unavailable due to technical reasons. Please try again later or contact We apologize for the inconvenience. Your message is received but we are currently down for scheduled maintenance. Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders. At this point, the amount you borrowed from your broking house will remain the same, whereas your own funds will drop to $2000, becoming lower than the 30% Margin requirement.

The big ‘but’ is that if the https://day-trading.info/ of Tesla went down by $15 to $585 a share, you would lose $150, which would be 12.5% of your deposit, assuming you haven’t placed a stop-loss order. There are two points at which we will aim to notify you that you are on margin call, before we start automatically closing positions. VALUTRADES LIMITED is a limited liability company registered in the Republic of Seychelles with its registered office at F20, 1st Floor, Eden Plaza, Eden Island, Seychelles.